A Lifetime of Value Through Comprehensive Financial Planning

“Planning and investing is much like planting an acorn and nurturing its growth. You begin by creating an environment that provides the greatest opportunity for steady development, focusing on a long-term commitment that will eventually produce optimum results.”

— Dr. Robert Halliday, Founder

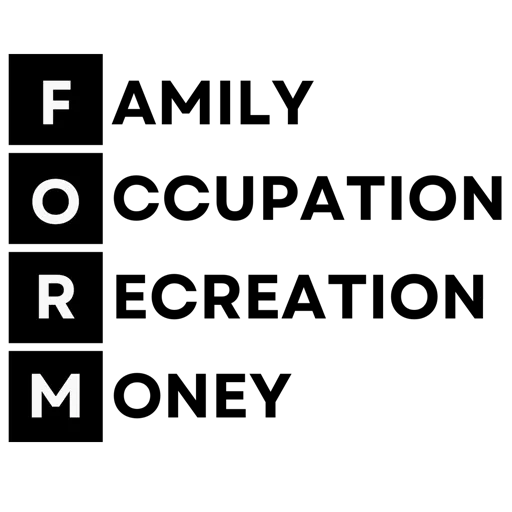

What Is the FORMation Process?

The FORMation Process provides clients with peace of mind, confidence, and control by offering access to a team of professionals committed to continuous improvement toward an ideal life.

While every family is unique, the FORMation process helps our clients plan around four core areas:

• Family – Protecting loved ones and building a multi-generational legacy

• Occupation – Creating flexibility and a work-optional lifestyle

• Recreation – Pursuing meaningful goals and unique life experiences

• Money – Aligning financial resources to support what matters most

Together, these elements form an integrated strategy that supports confident decision-making throughout every stage of life.

Who the FORMation Process Is For

The FORMation Process is best suited for small business owners, successful professionals, individuals and families who desire financial independence and are committed to a goals-based, comprehensive financial plan.

Our clients are often focused on building wealth, preserving it across generations, and creating a meaningful philanthropic impact. As life changes and needs evolve, the FORMation Process serves as a foundation of confidence, helping our clients put all the pieces of their financial lives in order. Ensuring the decisions we make together is always in the best interests of you and your family’s plan.

The best decisions are made when all aspects of your financial life—investments, cash flow, taxes, estate planning, and risk management—work together in harmony. As fiduciaries, we always act in your best interest, providing independent advice free from conflicts or proprietary products.

Preparing for Life’s Critical Financial Events

As our clients prepare for expected critical financial events—such as planning for retirement, selling a business, receiving an inheritance, purchasing a recreational property, or proactively planning their legacy, our resources and expertise help prepare in advance.

The FORMaiton process is also built to navigate unexpected critical life events such as the loss of a loved one, divorce or disability. The fluidity of the FORMation process allows our clients to focus on the matters at hand while their financial plan works seamlessly to support them.

This proactive approach allows our clients to achieve their financial and lifestyle goals with clarity, discipline, and confidence.

Begin the FORMation Process

If you are ready to create clarity and confidence around your financial future, we invite you to begin the FORMation Process.

Contact Us:

Jim Werner, CFP® - 516-671-0199 x245

Joe Tedeschi, CRPC® - 516-671-1099 x240

Chris Truncellito, CFP® – 516-671-1099 x387

Matt Monk, Financial Advisor – 516-671-1099 x37

Maggie Innelli, Associate - 516-671-1099 x378

Olivia Garry, Associate – 516-671-1099 x150

Our Partnership With You

Successful financial planning is built on effective communication, mutual trust, and respect. Our shared commitment includes:

• Your trust in our team and our recommendations

• Your commitment to working with us as your primary advisor

• Complete transparency about what matters most to you

We agree to keep each other informed of any developments that may affect your financial strategy and to always work together in the spirit of trust, respect, and understanding.